BESTAIR OÜ

Tegevuslugu

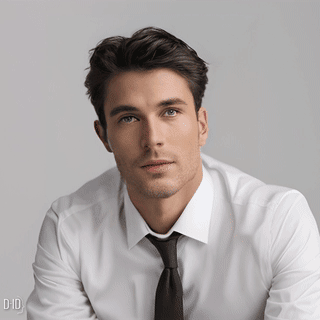

Ettevōtte juhtkond, meeskond ja kontaktid

BESTAIR OÜ hetkeolukord

Already 7,230 people have seen this company's branding and they are being followed by 21 Storybook user.In average the company has been rated 4.5 points ja kommenteeritud 1 kord.

's activity report 2022

The main activity of the limited company Bestair in 2022 was directed towards the wholesale of heating and cooling systems. The brands sold were Panasonic,

Ambista Electric. All the devices and spare parts sold are mainly supplied from the European Union. The limited company Bestair has been operating successfully since 2003.

Economic environment and its influences

No major investments were made during the financial year and it is planned to increase market share and turnover and profit growth in the next financial year.

The company's activity is seasonal and turnovers are higher during the heating period.

The war between Ukraine and Russia that began in February 2022 may have an impact on economic activity - consumer buying behavior may change and there may be delays in importing and delivering goods.

Risks of changes in exchange rates and interest rates

Several financial risks may be associated with the activities of Bestair Ltd: currency risk, credit risk, and interest risk, as well as tax risk.

Currency risk

The main currency used is EURO, which is the official fixed currency. NOK, DKK, SEK, and USD are also in use, which are stable currencies.

Credit risk

The company does not have significant credit risks. To reduce credit risks, the group continuously assesses the payment discipline of customers. The group does not have significant risks in relation to individual customers or other partners.

Interest risk

The rise in EURIBOR-related interest rates affects the profitability of the company to a small extent but may limit new investments in 2023.

The company has not used any instruments for its own hedging. According to the management, the interest risk is minimal.

The company has loan obligations such as overdraft, business loan.

Main financial ratios 2022 2021

Sales revenue 34 009 391 20 523 640

Turnover growth (decrease) 65.7% 39.94%

Gross profit margin 13.79% 14.52%

Operating profit 3 405 909 2 630 912

EBITDA 3 475 032 2 684 007

Net profit 3 130 920 2 349 996

Profit growth (decrease) 33.23% 583.99%

Net profitability 9.21% 11.45%

Solvency ratio 5.06 1.59

Debt ratio 0.47 0.61

Return on assets ROA 30 87% 33.56%

Return on equity ROE 59.16% 86.23%

Formulas used in calculating ratios:

Turnover growth (%) = (sales revenue 2022 - sales revenue 2021) / sales revenue 2021 * 100

Gross profit margin (%) = gross profit / sales revenue * 100

EBITDA = profit before financial income and expenses and depreciation

Profit growth (%) =(net profit 2022 - net profit 2021) / net profit 2021 * 100

Net profitability (%) = net profit / sales revenue * 100

BESTAIR OÜ contacts

The company's biggest cooperation partners

Add a new partner

Dropdown

File a complaint

Choose the comment attribute that you think it contains:

You want to report an inappropriate comment.

Are you sure?

Are you sure you want to delete this article?